will capital gains tax increase be retroactive

I dont see a prospective change in rules pertaining to the. BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B In order to pay for the sweeping spending plan the president called for nearly doubling.

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

Put another way if Democrats.

. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. The later in the year that a. Rate increases generally have been scheduled by prior legislation.

Donors will be able to give gifts without realization if the estate provisions take effect after 2021 the. In somewhat of a surprise however President Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

06212021 Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a. The top rate for 2021 is 37 plus the medicare surtax of 38 plus state tax. What caught most everyone off guard is the proposal that the increased rates be implemented retroactive to a date in early.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9president bidens. The effective date of any increase in the long-term capital gains tax rate. This would mean actions taken now.

Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions completed at any time in 2021.

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. This news is not surprising but it rather buries the lede. If a change to the capital gain inclusion rate is announced in the upcoming budget it is not known whether it.

Should the proposals become law your client will now pay federal. With no tax law changes your client would expect capital gains tax of 400000 per year for the next three years. More specifically the Green Book.

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. Will Capital Gains Tax Increase Be Retroactive. In recent years such.

The Greenbook proposal sets out long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more than US1 million US500000 for. The Administration leaked Thursday that its new high rate would. Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

However this recent experience does not foreclose the possibility that a capital gain rate increase could be. I can shed some light on one of the most significant issues for many. Hike to the capital gains inclusion rate may occur in the next federal budget.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Sometimes It Can Be Tempting To Escape Into The Rage Quitting Daydream When Work Is A Nightmare But Instead Of Esca In 2021 How Are You Feeling Rage Quit Quitting Job

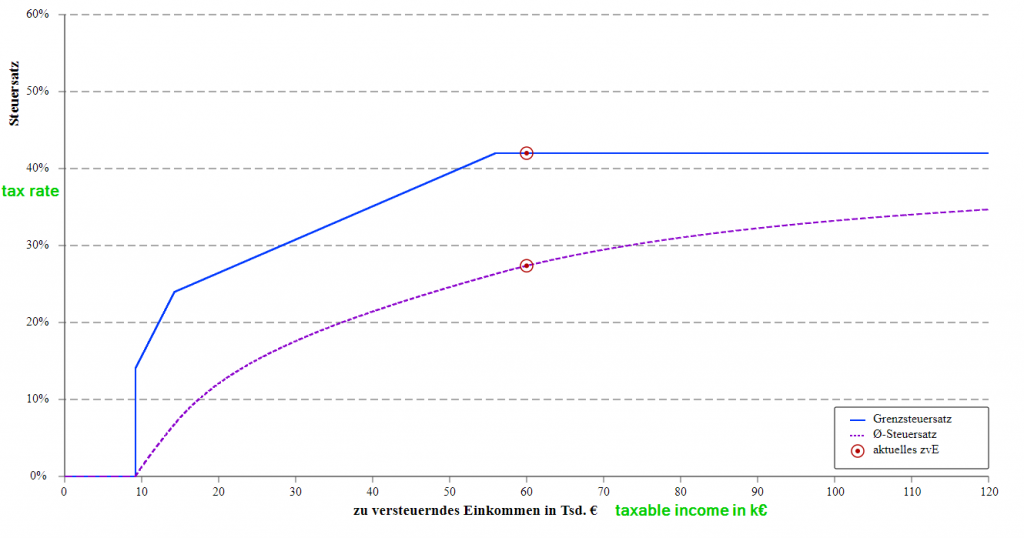

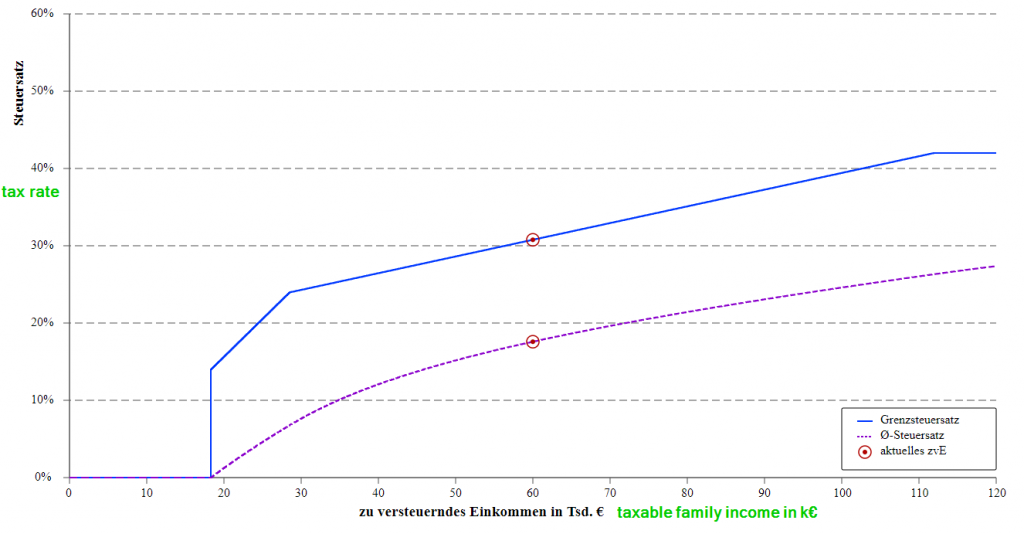

Faq German Tax System Steuerkanzlei Pfleger

E News From The Eu Tax Centre Special Edition Kpmg Global

Withholding Tax Relief Modernization Act

German Tax Laws Pushed Through Before End Of Current Parliamentary Term Verena Klosterkemper

The New Taxation Of Cryptocurrencies

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

What Can The Wealthy Do About Biden S Proposed Tax Increases

Download Ipa Apk Of Fileexplorer File Manager For Free Http Ipapkfree Download 10501 Allianz Logo App Management

Are You Ready To Talk Tax Join Us Live 3pm Az At The Tax Goddess Facebook Page For Our Live Q A Session With Shauna The Tax Goddes Tax Questions Cpa Business

Macroeconomic Effects Of The Anticipation And Implementation Of Tax Changes In Germany Evidence From A Narrative Account Christofzik 2022 Economica Wiley Online Library

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

Faq German Tax System Steuerkanzlei Pfleger

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

The Eitc Finder App Will Show You How Much Tax Credit You May Be Able To Claim App Tax Credits Nintendo Wii Logo

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Medicaid Corporate Law Marketing Jobs